Kattintson ide a magyar verzióért.

Kattintson ide a magyar verzióért.

Our Wealth Platform product supporting investment advice was launched around the same time when the challenging MiFID 2 legislation emerged. The complexity of the regulation no longer allowed our Clients to feel assured of full compliance without complex software solutions to support the work of their investment advisers. In response to this market demand and expectation, we have created the Client Meeting workflow in our Platform, which ensures that our Partners can serve their clients while staying fully compliant during each client meeting.

With the implementation of the SFDR and the rise of ESG products, investment service providers may feel that they are in a similar situation as when MiFID 2 was introduced. Although the SFDR legislation is less comprehensive and complex, its numerous articles are still uncertain, the detailed technical rules (RTS) have not yet been approved, well-established market practices are lacking, and market data providers have not yet been selected at many companies.

We know that a significant part of our personal success depends on the success of our Partners, so just as we were during the MiFID 2 implementation, we are ready to proactively support the market in successfully meeting new challenges and beyond that to promote their ESG products and transform their investment advice process. Our support is based on three pillars:

- We hold workshops with our partners: We discuss the parts of the legislation related to investment advice and determine together which software functions would help them the most.

- Gather best practice solutions: We have numerous customers in the region, therefore we have the opportunity to see how the market is responding to the growing demand for ESG products and new legislation. We are ready to share our accumulated knowledge with our partners to support their operations.

- We develop new ESG / SFDR modules and features: Utilising our investment software development background and business teams with significant market experience, we develop new features in our products that support our partners not only in complying with SFDR legislation but also in promoting ESG-based investments.

With a few adjustments and quick developments in our Wealth Management advisory platform we can greatly advance compliance with SFDR and more actively shift customer conversations towards ESG-based investment products.

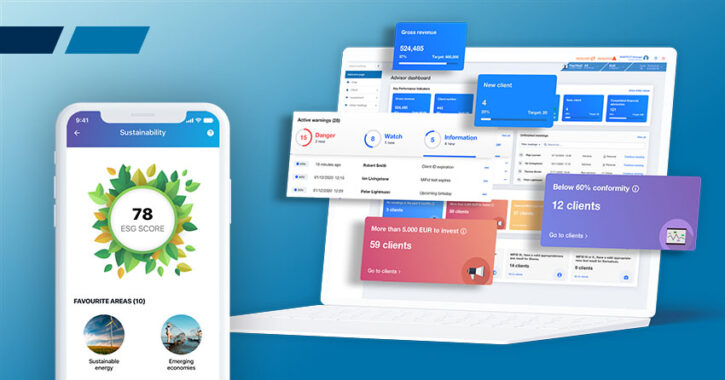

- Client Meeting workflow: By creating a dedicated sustainability step, advisors can see all the mandatory information to be presented in one place, such as integrating sustainability risks or information on ESG ratings of recommended products. In addition, the level of sustainability of the client portfolio and its change after rebalancing can be visualized as well.

- Customer Profiling: Similar to our suitability and appropriateness tests, a new questionnaire can be created to measure customers’ openness to sustainable investments. This allows our partners to promote their existing ESG products and increase their customer satisfaction with more fitting product offerings.

- Product sheets: On the product page of each investment product we can show what ESG rating the product has, what risks are associated with it, to whom it is recommended, etc.

- Reporting: The generated documents to be submitted at the end of the advisory process can also indicate how the composition of the portfolio has changed according to ESG and what suitability and SFDR-related information was provided during the meeting.

We believe that the new legislation and the growing customer demand for sustainability hold not only a challenge but also an opportunity for market participants. In order to turn this opportunity into successful customer relationships, we are ready to support our partners in all areas, both in complying with the law and in improving the quality of their customer service.