Kattintson ide a magyar verzióért.

Kattintson ide a magyar verzióért.

The securities market of every country is the pulse of the national economy. This market in itself is self-learning and self-operated in a way that almost resembles AI, but also heavily regulated. Economic experts recognised in time that the prosperity of well-functioning developed countries depends not only on the maintenance of budget deficits, foreign trade balances and the monetary policy of the central bank, but also on a well-functioning tax and pension system where self-care is paramount.

With the creation of the 3-pillar pension system, the securities markets in the CEE region revived and an explosive economic growth began, the first private and voluntary pension funds, the asset management, portfolio management, and insurance businesses were established and began to expand at a crazy pace.

With the emergence of the new entrants and the creation of huge securities portfolios, new regulations were needed that regulated not only distribution, asset management and portfolio management but almost every aspect of their operations.

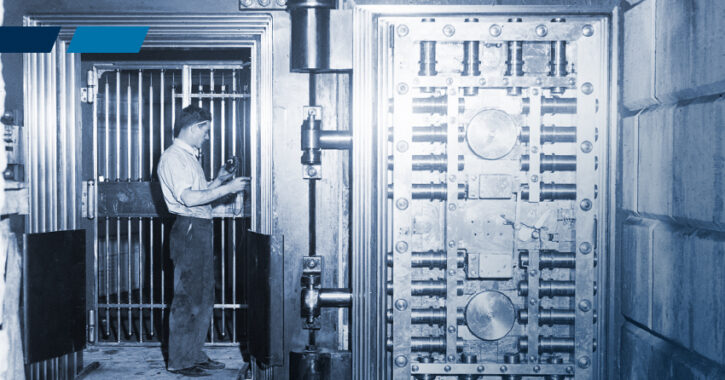

With the emergence of new securities market participants, a new custody back office activity was created, which entrusted a significant task to custodians. This task is the responsibility of the watchmen, who monitor the ‘limits’ in accordance with the asset management rules of the investment funds, not allowing the proportion of asset groups to be exceeded, and calculate the net asset value by which the market value of a portfolio in relation to individual units is determined on a day-to-day basis. This gives investors a real-time picture of the market value of the portfolio package, their investment policy and allows them to make an independent decision to choose an already ‘well’ diversified investment package in addition to risky share and boring government securities.

For custodian banks, a Net Asset Value calculation system was essential for this ‘watchman’ role, supporting the daily tasks of not only custodians but also new entrants through digitisation. The custodian banks keeping accounts with the new entrants and their customers were held jointly liable.

With the appearance of foreign securities deposited in portfolio packages, foreign sub-custodians and clearing houses were connected to the circulation along with data providers (Reuters, Bloomberg) that enabled daily market prices to be reached through online channels via the World Wide Web.

The operation and daily process of each market participant was different, so an IT system could not provide a solution to all participants globally. Therefore, ‘taylormade’ customized modules and systems were needed, where the customer could also provide the market regulations and the reports required by the Supervisory Authorities that appeared in the meantime, not to mention the fee calculation, which they had to fulfil and calculate for more and more participants.

Due to the management of foreign securities in investment funds and pension fund portfolios, custodian banks had to open securities accounts with foreign (Western European, American, Asian, African) sub-custodian banks, which are also account managers in local securities markets. To date, domestic or regional custodian banks regulate the scope of custody services with foreign sub-custodians and clearing houses and their foreign customers in SLAs and comprehensive custody agreements, including all communication channels, the content and frequency of notifications. A custodian bank that wins a group of customers can maintain securities accounts of up to thousands of segregated (named) customers, thus selecting an Institution with the appropriate level of service is a cross-border task of regional custody (i.e., for the markets of all CEE member states), by completing an RFI (Request for information), RFP (Request for proposal) consisting of hundreds of questions, with a ‘tour of operation’, which is a personal mapping of the operating system of local custodians, with an in-service view, analysis of STP processes.

From a simple local custody service, a provider can grow to be a global custodian by providing a ‘standardised’ service custody. This is achieved by operating as a regional Bank Group with the integration of foreign markets, reaching all of the world’s securities markets due to the increased number of customers and securities. This continuous level of securities custody service is supported by Global Relationship Managers, with continuous front-office monitoring and compliance with contractual operation. In the background, there should be properly developed back-office securities and cash account management systems and other IT systems that are properly digitised for audit, controlling and compliance, which run STP workflows, and use the SWIFT communication channel. The service undertaken by custody agreements is reviewed by customers each year as part of a Due Diligence Visit. It is therefore essential that, after the conclusion of the contract, the custodian can ensure the constant quality of the service at all times.

In fact, the global securities custody service is where customer needs no longer know boundaries, demanding newer and newer products and services from securities market participants, going far beyond custody, account management, reconciliation, reporting, settlement, corporate event management and net asset valuation processes. Treasury products, securities lending, daily cash and securities liquidity services are all belong here, supplemented with additional ‘expected’ tasks, which may even mean tax and other legal compliance and continuous market information sharing.

Sign up to find out more about the topic in our new white paper.